TV Old timers probably remember the scene at the end of the Flintstones where Fred threw the sabertoothed tiger out of the house at nightfall. Turning the tables, the nasty critter jumps through the window, tosses Fred through the front door, and locks him out.

A different feline ticker symbol, Caterpillar (CAT), has been thrown out of a lot of investors' portfolios in recent months. Today's quarterly EPS of $1.45 (most analysts, such as Value Line and Yahoo Finance, expected closer to $1.68) and nearly 20% decline in revenues will keep this "cat" in the doghouse for a while.

But should it? Given the worldwide troubles in the mining sector, the decline in revenues was widely expected. But sales in China were a bright spot, up a sprightly 20% so far in 2013.

More importantly for long term investors, the steady drumbeat of bad news over the last three quarters has so far been unable to push the stock to new lows. Long term investors (and of course short term traders) should always be on the lookout for

stocks that refuse to advance in the face of strong earnings. The market is signaling that those shares are fully valued.stocks that refuse to decline in the face of weak earnings. In this case, the market may be signaling that CAT shares are undervalued.Sure: Caterpillar shares are down over 5% today. But there is a solid floor of support for the shares just a few dollars below current levels.

(click to enlarge)

source: bigcharts.com

Investors who wait for an earnings recovery before buying this stock will surely end up paying a far greater price: notice how shares began to surge in 2009 almost five quarters before profitability turned around. The base forming at $80 suggests smart money is acquiring shares at this level: notice how on-balance volume has been stronger in the last few months even as share prices have tread water.

! Seeking Alpha readers are well acquainted with VIX, the market "fear index" based upon the implied volatility of S&P500 index options. A similar index can be calculated for companies such as CAT based upon the implied volatility of their options.

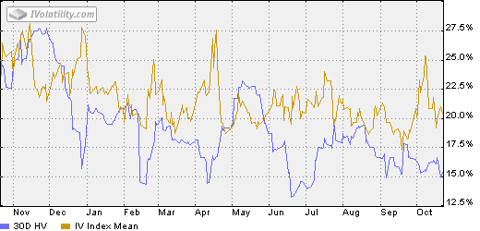

The chart below shows that the overall level of fear of owning this company's shares has trending downward over the last year.

(click to enlarge)

source: www.ivolatility.com

Thus I believe the market already expects the worst for CAT and is "looking across the valley" of earnings weakness in the near term, to the recovery that should appear in 2014. Where might this recovery come from? Europe appears to have turned the corner; China revenue growth, as mentioned before, is very strong even as that nation's economy slows a bit; and more clarity on the U.S. Federal Budget for 2014 (now that the shutdown has been terminated) has tempered the Federal Reserve's prospects for higher interest rates. All bode well for companies selling capital goods, especially infrastructure related goods which are this company's forte.

At current prices the shares yield a handsome 2.8%. Not only is the dividend well covered, it has nearly tripled in the last decade and was not cut even in the dark days of the crash. I recommend investors place a stop order to buy the shares at $80 (to allow for additional weakness) with a stop loss at $76 a share.

Shaving Value Line's estimate of $7.15 for 2014 a bit to reflect recent weakness, and applying the current P/E ratio of 13x to an estimate of $7.00, we get a price target of $91. A cash flow multiple of 8x applied to next year's estimate of nearly $12 (also from Value Line) leads to a very similar target price ($96). Taking the lower end of the range of $92 a share, this represents nearly a 15% gain in the share price, if you can pick them off at their lower levels. While yo! u would b! oast nearly a 10% gain if you secured them at their current price, such a gain would not be satisfactory given the above average risk in these shares.

The Red Sox and Cardinals, this years World Series contenders, can tell you the importance of "waiting for a good pitch to hit." It is much the same with CAT at the moment: be patient and try to get the shares at a slightly better price. You will be well rewarded: at that level the steadily growing dividend will give you a current yield of 3.0%

Source: Time To Bring The 'Cat' Back In?Top 10 Low Price Stocks To Invest In Right Now

Disclosure: I am long CAT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: I own Caterpillar through my holdings in ETFs

No comments:

Post a Comment