On Tuesday, Smith & Wesson Holding (NASDAQ: SWHC ) will release its quarterly report, and shareholders have been pleased to see continued share-price gains from the gunmaker. Yet along with rival Sturm, Ruger (NYSE: RGR ) , Smith & Wesson is in danger of seeing earnings top out, and many investors wonder whether the good times for the gun industry will last or whether the recent move from Alliant Techsystems (NYSE: ATK ) to spin off its firearms and sporting segment marks a high-water mark for Smith & Wesson and other gun manufacturers.

Smith & Wesson has been the ultimate contrarian investing play, as many people expected that tougher gun regulation would hurt sales and bring Smith & Wesson, Sturm, Ruger, and other gunmakers to their knees. Yet in many ways, the opposite has been true, as the threat of tighter gun regulation has led to higher short-term sales. Still, even the gun companies themselves have warned that short-term effects could eventually give way to slower growth, and the question is whether that time has come or whether further growth opportunities still exist. Let's take an early look at what's been happening with Smith & Wesson over the past quarter and what we're likely to see in its report.

Source: Smith & Wesson.

Stats on Smith & Wesson

| Analyst EPS Estimate | $0.39 |

| Change From Year-Ago EPS | (11.4%) |

| Revenue Estimate | $163.55 million |

| Change From Year-Ago Revenue | (8.5%) |

| Earnings Beats in Past 4 Quarters | 3 |

Source: Yahoo! Finance.

Will Smith & Wesson earnings start shrinking?

In recent months, analysts have boosted their views on Smith & Wesson earnings, raising April-quarter estimates by $0.02 per share and increasing their fiscal 2015 projections by about 4%. The stock has kept soaring, with gains of 37% since late February.

Most of Smith & Wesson's gains came early in the quarter, when the gunmaker announced its earnings for the January quarter. Sales jumped more than 7% from the year-ago quarter despite the loss of revenue from Smith & Wesson's arrangement with Walther Arms, and net income from continuing operations rose nearly 35% on a roughly 30% rise in handgun sales. Moreover, Smith & Wesson gave positive guidance for the April quarter, boosting estimates for the full fiscal year as well.

Source: Smith & Wesson.

What was particularly impressive about Smith & Wesson's results is that investors were so much more pleased with them than they were with what rival Sturm, Ruger posted. For its part, Sturm Ruger saw a 33% jump in earnings per share, but shareholders weren't satisfied with that performance and sold off the shares accordingly. Investors have clearly gotten spoiled from such high demand last year that Sturm Ruger wasn't able to keep up, but they nevertheless appear to be concerned about what might be the looming end of the current strength in gun sales, as background-check volume has plunged in recent quarters and sporting-goods retailers have seen weaker sales as well. That might also be part of the justification for Alliant Techsystems choosing to spin off its Savage Arms and other sporting-goods brands into a separate entity.

Best Defensive Companies To Own For 2015

Still, Smith & Wesson appears to be holding up well. Earlier this month, one analyst firm upgraded the company's stock, arguing that Smith & Wesson's new handgun launches are faring well, especially in jurisdictions that allow concealed handguns. If Smith & Wesson can demonstrate its superiority over Sturm Ruger in the eyes of consumers, then it might be a long-term winner even if gun demand returns to more normal levels.

In the Smith & Wesson earnings report, watch to see what comments the company's management has about the future trends in gun sales. Given how long skeptics have been calling for weaker sales, it wouldn't be surprising if Smith & Wesson could forestall the long-awaited setback for at least one more quarter.

You can't afford to miss this

"Made in China" -- an all too familiar phrase. But not for much longer: There's a radical new technology out there, one that's already being employed by everyone from the U.S. Air Force to BMW. Respected publications like The Economist have compared this disruptive invention to the steam engine and the printing press; Business Insider calls it "the next trillion-dollar industry." Watch The Motley Fool's shocking video presentation to learn about the next great wave of technological innovation, one that will bring an end to "Made In China" for good. Click here!

Click here to add Smith & Wesson to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.

Popular Posts: 5 Beaten-Down Stocks to Buy4 Small-Cap Stocks to Scoop Up While They’re on SaleThis Year’s 5 Hottest Marijuana Stocks Recent Posts: 5 Dividend Stocks You Never Saw Comin’ 4 (More) Industries Google Could Dominate Sears Holdings (SHLD): A Ticking Time Bomb That’s Speeding Up View All Posts

Popular Posts: 5 Beaten-Down Stocks to Buy4 Small-Cap Stocks to Scoop Up While They’re on SaleThis Year’s 5 Hottest Marijuana Stocks Recent Posts: 5 Dividend Stocks You Never Saw Comin’ 4 (More) Industries Google Could Dominate Sears Holdings (SHLD): A Ticking Time Bomb That’s Speeding Up View All Posts  AT&T (T). Verizon (VZ). McDonald’s (MCD). Consistent payers-and-raisers for years, and everyone knows it.

AT&T (T). Verizon (VZ). McDonald’s (MCD). Consistent payers-and-raisers for years, and everyone knows it. Dividend Yield: 3.1%

Dividend Yield: 3.1% Dividend Yield: 3.2%

Dividend Yield: 3.2% Dividend Yield: 3.4%

Dividend Yield: 3.4% Dividend Yield: 4%

Dividend Yield: 4% Dividend Yield: 3.4%

Dividend Yield: 3.4%

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  6.96 (1y: -9%) $(function(){var seriesOptions=[],yAxisOptions=[],name='HIMX',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1369026000000,7.67],[1369112400000,7.3],[1369198800000,7],[1369285200000,7.15],[1369371600000,7],[1369717200000,6.81],[1369803600000,6.66],[1369890000000,7.44],[1369976400000,7.2],[1370235600000,7.13],[1370322000000,6.98],[1370408400000,6.8],[1370494800000,6.61],[1370581200000,6.82],[1370840400000,6.87],[1370926800000,6.52],[1371013200000,6.21],[1371099600000,5.85],[1371186000000,5.39],[1371445200000,5.65],[1371531600000,5.61],[1371618000000,5.55],[1371704400000,5.23],[1371790800000,5.06],[1372050000000,4.87],[1372136400000,4.91],[1372222800000,5.46],[1372309200000,5.34],[1372395600000,5.22],[1372654800000,5.55],[1372741200000,5.46],[1372827600000,5.5],[1373000400000,5.69],[1373259600000,5.49],[1373346000000,5.4],[1373432400000,5.24],[1373518800000,5.19],[1373605200000,5.64],[1373864400000,6.02],[1373950800000,5.7],[1374037200000,5.39],[1374123600000,5.35],[1374210000000,5.17],[1374469200000,6.74],[1374555600000,7.27],[1374642000000,7.59],[1374728400000,7.33],[1374814800000,7.3],[1375074000000,7.18],[1375160400000,6.82],[1375246800000,6.51],[1375333200000,6.55],[1375419600000,6.57],[1375678800000,6.41],[1375765200000,6.99],[1375851600000,6.62],[1375938000000,6.64],[1376024400000,6.65],[1376283600000,6.72],[1376370000000,6.67],[1376456400000,6.7],[1376542800000,6.12],[1376629200000,6.075],[1376888400000,5.78],[1376974800000,5.89],[1377061200000,5.93],[1377147600000,6.14],[1377234000000,6.11],[1377493200000,6.06],[1377579600000,5.79],[1377666000000,5.91],[1377752400000,6.17],[1377838800000,6.07],[1378184400000,6.48],[1378270800000,7.35],[1378357200000,8.62],[1378443600000,8.079],[1378702800000,8.11],[1378789200000,8.47],[1378875600000,9.18],[1378962000000,8.67],[1379048400000,8.79],[1379307600000,8.69],[1379394000000,9.11],[1379480400000,9.725],[1379566800000,10.04],[1379653200000,10.76],[1379912400000,10.47],[1379998800000,10.42],[1380085200000,10.14],[1380171600000,10.15],[13! 80258000000,9.72],[1380517200000,10],[1380603600000,10.53],[1380690000000,11.02],[1380776400000,10.79],[1380862800000,10.94],[1381122000000,10.61],[1381208400000,10.08],[1381294800000,10.21],[1381381200000,10.82],[1381467600000,10.685],[1381726800000,10.68],[1381813200000,10.48],[1381899600000,10.4],[1381986000000,10.285],[1382072400000,10.69],[1382331600000,10.399],[1382418000000,10.22],[1382504400000,9.929],[1382590800000,9.675],[1382677200000,9.54],[1382936400000,9.635],[1383022800000,10.295],[1383109200000,10.16],[1383195600000,9.675],[1383282000000,9.52],[1383544800000,10.11],[1383631200000,9.92],[1383717600000,9.47],[1383804000000,8.505],[1383890400000,8.75],[1384149600000,9.33],[1384236000000,9.15],[1384322400000,9.425],[1384408800000,9.33],[1384495200000,9.2],[1384754400000,9.14],[1384840800000,9.36],[1384927200000,9.2],[1385013600000,9.16],[1385100000000,9.43],[1385359200000,9.27],[1385445600000,9.43],[1385532000000,10.38],[1385704800000,10],[1385964000000,10.01

6.96 (1y: -9%) $(function(){var seriesOptions=[],yAxisOptions=[],name='HIMX',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1369026000000,7.67],[1369112400000,7.3],[1369198800000,7],[1369285200000,7.15],[1369371600000,7],[1369717200000,6.81],[1369803600000,6.66],[1369890000000,7.44],[1369976400000,7.2],[1370235600000,7.13],[1370322000000,6.98],[1370408400000,6.8],[1370494800000,6.61],[1370581200000,6.82],[1370840400000,6.87],[1370926800000,6.52],[1371013200000,6.21],[1371099600000,5.85],[1371186000000,5.39],[1371445200000,5.65],[1371531600000,5.61],[1371618000000,5.55],[1371704400000,5.23],[1371790800000,5.06],[1372050000000,4.87],[1372136400000,4.91],[1372222800000,5.46],[1372309200000,5.34],[1372395600000,5.22],[1372654800000,5.55],[1372741200000,5.46],[1372827600000,5.5],[1373000400000,5.69],[1373259600000,5.49],[1373346000000,5.4],[1373432400000,5.24],[1373518800000,5.19],[1373605200000,5.64],[1373864400000,6.02],[1373950800000,5.7],[1374037200000,5.39],[1374123600000,5.35],[1374210000000,5.17],[1374469200000,6.74],[1374555600000,7.27],[1374642000000,7.59],[1374728400000,7.33],[1374814800000,7.3],[1375074000000,7.18],[1375160400000,6.82],[1375246800000,6.51],[1375333200000,6.55],[1375419600000,6.57],[1375678800000,6.41],[1375765200000,6.99],[1375851600000,6.62],[1375938000000,6.64],[1376024400000,6.65],[1376283600000,6.72],[1376370000000,6.67],[1376456400000,6.7],[1376542800000,6.12],[1376629200000,6.075],[1376888400000,5.78],[1376974800000,5.89],[1377061200000,5.93],[1377147600000,6.14],[1377234000000,6.11],[1377493200000,6.06],[1377579600000,5.79],[1377666000000,5.91],[1377752400000,6.17],[1377838800000,6.07],[1378184400000,6.48],[1378270800000,7.35],[1378357200000,8.62],[1378443600000,8.079],[1378702800000,8.11],[1378789200000,8.47],[1378875600000,9.18],[1378962000000,8.67],[1379048400000,8.79],[1379307600000,8.69],[1379394000000,9.11],[1379480400000,9.725],[1379566800000,10.04],[1379653200000,10.76],[1379912400000,10.47],[1379998800000,10.42],[1380085200000,10.14],[1380171600000,10.15],[13! 80258000000,9.72],[1380517200000,10],[1380603600000,10.53],[1380690000000,11.02],[1380776400000,10.79],[1380862800000,10.94],[1381122000000,10.61],[1381208400000,10.08],[1381294800000,10.21],[1381381200000,10.82],[1381467600000,10.685],[1381726800000,10.68],[1381813200000,10.48],[1381899600000,10.4],[1381986000000,10.285],[1382072400000,10.69],[1382331600000,10.399],[1382418000000,10.22],[1382504400000,9.929],[1382590800000,9.675],[1382677200000,9.54],[1382936400000,9.635],[1383022800000,10.295],[1383109200000,10.16],[1383195600000,9.675],[1383282000000,9.52],[1383544800000,10.11],[1383631200000,9.92],[1383717600000,9.47],[1383804000000,8.505],[1383890400000,8.75],[1384149600000,9.33],[1384236000000,9.15],[1384322400000,9.425],[1384408800000,9.33],[1384495200000,9.2],[1384754400000,9.14],[1384840800000,9.36],[1384927200000,9.2],[1385013600000,9.16],[1385100000000,9.43],[1385359200000,9.27],[1385445600000,9.43],[1385532000000,10.38],[1385704800000,10],[1385964000000,10.01

Dhiraj Singh/Bloomberg News

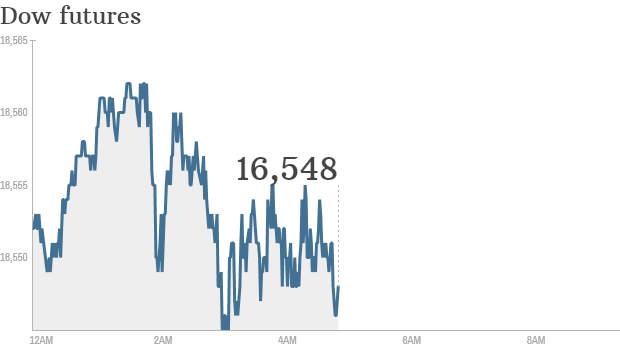

Dhiraj Singh/Bloomberg News  NEW YORK (CNNMoney) Markets look set to ignore rising tension in Ukraine Monday and the Dow Jones industrial average could power forward to new record highs.

NEW YORK (CNNMoney) Markets look set to ignore rising tension in Ukraine Monday and the Dow Jones industrial average could power forward to new record highs.