Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

What: Shares of energy service provider Matrix Service (NASDAQ: MTRX ) jumped 10% today after an analyst upgraded the stock.

So what: Analysts at Sidoti upgraded the stock from "neutral" to "buy" today. This was the only news out about the stock and drove traders to push volume to nearly twice its three-month average. �

Now what: At The Motley Fool, we don't take analyst upgrades too seriously, and over time the market forgets about them as well. This will probably be a short-term bump for the stock, and I wouldn't view it as a reason to buy. Without a new catalyst to push the stock higher, the upgrade will be forgotten and the buyers who hit the market today will leave, pushing the stock lower.

Interested in more info on Matrix Service Company? Add it to your watchlist by clicking here.

Best Energy Companies To Own In Right Now: PROS Holdings Inc.(PRO)

PROS Holdings, Inc. provides pricing and margin optimization software worldwide. It offers PROS Pricing Solution Suite, a set of integrated software products that enables enterprises to apply pricing and margin optimization science to determine, analyze, and execute optimal pricing strategies through the aggregation and analysis of enterprise application data, transactional data, and market information. The PROS Pricing Solution Suite consists of Scientific Analytics to gain insight into pricing performance; Price Optimizer to institute control of pricing policies; and Deal Optimizer to provide guidelines, additional context, and information to sales force. Its products also include PROS Revenue Management Solution Suite, a suite of industry specific revenue management software products for the enterprises in travel target markets. The PROS Revenue Management Solution Suite comprises PROS Analytics to identify hidden revenue leaks and opportunities, PROS Revenue Management product to manage passenger demand with leg- or segment-based revenue optimization, PROS O&D products to manage passenger demand with passenger name record or PNR based revenue optimization, PROS Real-Time Dynamic Pricing product to determine the optimal prices, PROS Group Revenue Management product to manage group request and booking revenues, PROS Network Revenue Planning product to deliver network-oriented fare class segmentation, PROS Cruise Pricing and Revenue Optimization for customers to understand consumers price sensitivities and track competitor behavior, PROS Hotel Revenue Optimization product that helps customers to enhance pricing decision. In addition, the company provides pricing and implementation professional, and ongoing support and maintenance services. It serves customers in the manufacturing, distribution, services, hotel and cruise, and airline industries primarily through its direct sales force. The company was founded in 1985 and is headquartered in Houston, Texas.

Best Energy Companies To Own In Right Now: SolarCity Corp (SCTY.W)

SolarCity Corporation (SolarCity), incorporated on June 21, 2006, is engaged in the design, installation and sale or lease of solar energy systems to residential and commercial customers, or sale of electricity generated by solar energy systems to customers. The Company sells renewable energy to its customers. As of December 12, 2012, the Company served customers in 14 states. The Company�� residential customers are individual homeowners and homeowners. The Company�� commercial customers represent several business sectors, including technology, retail, manufacturing, agriculture, nonprofit and houses of worship. The Company has installed solar energy systems for several government entities, including the the United States Air Force, Army, Marines and Navy, and the Department of Homeland Security. The Company purchases major components, such as solar panels and inverters directly from multiple manufacturers. As of September 30, 2012, its primary solar panel suppliers were Trina Solar Limited, Yingli Green Energy Holding Company Limited and Kyocera Solar, Inc., among others, and its primary inverter suppliers were Power-One, Inc., SMA Solar Technology, AG, Schneider Electric SA, Fronius International GmbH and SolarEdge Technologies, among others.

Solar Energy Products

The Company�� solar energy products include Solar Energy Systems, and SolarLease and power purchase agreement finance products. The major components of its solar energy systems include solar panels that convert sunlight into electrical current. Most of its solar energy customers choose to purchase energy from the Company pursuant to one of two payment structures: a SolarLease or a power purchase agreement. In both structures, the Company charges customers a monthly fee for the power produced by its solar energy systems. In the lease structure, this monthly payment is pre-determined and includes a production guarantee. In the power purchase agreem ent structure, the Company charges customers a fee per kilo! w! att hour based on the amount of electricity actually produced by the solar energy system.

Energy Efficiency Products and Services

The Company�� energy efficiency products and services include home energy evaluation and energy efficiency upgrades. The Company sells home energy efficiency evaluations to new solar energy system customers and existing customers. The Company�� energy efficiency upgrade products and services address heating and cooling, air sealing, duct sealing, water heating, insulation, furnaces, weatherization, pool pumps and lighting. As of December 12, 2012, the Company had completed over 13,000 home energy evaluations and performed more than 2,000 energy efficiency upgrades.

Other Energy Products and Services

The Company�� other energy products and services include electric vehicle charging and energy storage. The Company installs electric vehicle (EV) charging equipment that it sources from t hird parties. SolarCity markets EV equipment to residential and commercial customers through retail partnerships with companies, such as The Home Depot, and through EV manufacturers and dealerships, such as its partnership with Tesla Motors, Inc. The Company is developing a battery management system built on its solar energy monitoring communications backbone. As of December 12, 2012, the Company had over 100 energy storage pilot projects under contract. As of December 12, 2012, the Company had sold over 750 charging stations.

Enabling Technologies

The Company�� enabling technologies include SolarBid Sales Management Platform, SolarWorks Customer Management Software, Energy Designer, Home Performance Pro and SolarGuard and PowerGuide Proactive Monitoring Solutions. SolarBid is a sales management platform, which incorporates a database of rate information by utility, sun exposure, roof orientation and a range of other factors to enable a detailed a nalysis and customized graphical presentation of each c! ustom! er! �� sa! vings.

SolarWorks is the software platform the Company uses to track and manage project. Energy Designer is a software application its field engineering auditors use to collect pertinent site-specific design details on a tablet computer. Home Performance Pro is its energy efficiency evaluation platform that incorporates the United States Department of Energy�� Energy Plus simulation engine. Home Performance Pro collects and stores details of a building�� construction and energy use. SolarGuard and PowerGuide provide its customers a view of their home�� or business�� energy generation and consumption.

The Company competes with American Solar Electric, Inc., Astrum Solar, Inc., Petersen Dean, Inc., Real Goods Solar, Inc., REC Solar, Inc., Sungevity, Inc., Trinity Solar, Inc., Verengo, Inc., SunRun Inc. and Ameresco, Inc.

Peabody Energy Corporation engages in the mining of coal. It mines, prepares, and sells thermal coal to electric utilities and metallurgical coal to industrial customers. The company owns interests in 30 coal mining operations located in the United States and Australia, as well as owns joint venture interest in a Venezuela mine. It is also involved in marketing, brokering, and trading coal. In addition, the company develops a mine-mouth coal-fueled generating plant; and Btu Conversion projects that are designed to convert coal to natural gas or transportation fuels; and clean coal technologies. As of December 31, 2011, it had 9 billion tons of proven and probable coal reserves. The company was founded in 1883 and is headquartered in St. Louis, Missouri.

Advisors' Opinion: - [By Taylor Muckerman and Joel South]

We have evidence in the form of second-quarter results from Peabody Energy (NYSE: BTU ) , Freeport-McMoRan Copper & Gold (NYSE: FCX ) and Southern Copper (NYSE: SCCO ) , all three of which hinted at where they believe the two industries are headed. Going over the conference calls, Motley Fool analyst Taylor Muckerman gathered a few interesting tidbits and discusses them with fellow analyst Joel South in the following video.�

Best Energy Companies To Own In Right Now: Solar Energy Initiatives Inc (SNRY)

Solar Energy Initiatives, Inc., incorporated on June 20, 2006, is a provider of solar solutions with three wholly owned subsidiaries focused on projects, solar education and distribution of solar products. Its products include solar panels, inverters, solar thermal systems, system design, financial consulting and analysis, construction management, and maintenance and monitoring. The SNRYPower subsidiary is a developer and manager of municipal and commercial scale solar projects. The Solar-EOS Inc subsidiary is engaged in education and continuous improvement of solar energy trade professionals. The SNRYSolar Inc subsidiary is a wholesale distributor of branded photovoltaic and thermal (water heating) systems selling via a network of dealers throughout the United States and the Caribbean. During the fiscal year ended July 31, 2010 (fiscal 2010), the Company sold its interests in SolarEnergy.com, a domain name and digital property back to its original owner. In February 2011, the sold its Solar (EOS) Division.

Solar EOS, Inc.

Solar EOS, Inc. is a wholly owned subsidiary of Solar Energy Initiatives, Inc. It is an education group dedicated to the creation, training, advancement and continuous improvement of professionals through standard and customized solar training programs and workforce development. It supports the growth of the solar industry through training and education. Solar EOS provides training through its Professional Development Institute and through its Technical Installation Schools, as well as through its Customized Training Programs.

Professional Development Institute offers programs to architects, engineers, general contractors, roofers, plumbers, facility managers and owner�� representatives. The institute offers solar courses to members of the professional communities. Many courses provide needed continuing education units for licensure and professional registrations. Solar EOS is also an approved Ukulele Society of Great Britain (USGB) Educatio! n Provider. These classes are paid for by the professional or his company when taking the course.

Technical Installation Schools focus on workforce development and public/private partnerships. The school trains the next generation of solar thermal and photovoltaic installers in construction best practices, utilizing hands-on training, real world situations, theory and design coursework, and professional development training. Career Services programs, partnerships and dealer relationships drive the job placement of the students. These courses are paid for by the business rather than the individuals.

Customized Training Programs work through partnerships with universities, community and technical colleges, non profits, corporations, professional organizations, municipalities and workforce redevelopment agencies to meet the specific needs of groups of students. The Company writes the curriculum, provides the instructors, coordinates workshops, develops training programs, and hosts webinars and on-demand webcasts. The students do not pay for the course but is paid for through a variety of government programs in the form of a grant. As of October, 2010, the Company entered the fourth class for the Technical Installation School and graduated over 50 students, and trained more than 100 professionals in its Professional Development Institute.

SNRY Solar Inc.

SNRY Solar Inc. is a wholly owned subsidiary of Solar Energy Initiatives, Inc. (SEI). SNRY Solar is responsible for two areas: wholesale sales and government programs. SNRY Solar represents several manufacturers of solar systems and components in the Photovoltaic (PV), Solar Thermal / Hot Water (HW) and solar pool heating systems. SNRY Solar inventories and sells these components and systems to a network of installers, dealers and other business types across the United States and the Caribbean. SNRY Solar provides technical information, supply coordination and extensive sales support to aide these indep! endent bu! sinesses.. These support functions include but are not limited to preliminary engineering, scoping and drawings to support sales activity as well as lead generation tools, product recommendation and proposal support. SNRY Solar has developed business models which engage community groups, local, state and federal leaders and grass roots organizations to seek available funds to support job creation through solar.

SNRY POWER Inc.

SNRY POWER Inc. is a wholly owned subsidiary that focuses on developing solar photovoltaic (PV) panel systems for either mounting on the ground or on rooftops. These systems, once installed, generate electricity that is sold to various third parties including utilities, home and business owners, municipalities and other government agencies. In the Power Purchase Agreement (PPA) program, the Company builds the PV system at no charge to the host (the municipality or other customer). The system is built on space (either land or rooftop) provided by the host in exchange for a reduction in the hosts payment for electricity (usually expressed in cents per kilowatt hour (KWh).

The Company is constructing a one mega watt (MW) ground mounted solar PV system on land provided by the Cherokee School District in North Carolina. It has secured construction financing to build 50% of the system and considering selling the system in fiscal 2010.

Solar panels are solar cells electrically connected together and encapsulated in a weatherproof package. The Company purchases from Suntech, GE Solar, BP Solar and other vendors in the Unites States and off-shore. Inverters transform direct current (DC), electricity produced by solar panels into alternating current (AC), electricity used in homes and businesses. Inverters are used in every on-grid solar power system and feed power either directly into the structure�� electrical circuit or into the utility grid. In North America, it sells branded inverters designed for use in residential and commercia! l systems.! Inverters it sources include models spanning a power range of 2.5 to 500 kilowatts. Its inverters are manufactured by Solectria, Xantrex, SMA Technologies, AG and PV Powered. Solar thermal systems include a solar collector, which gathers solar radiation to heat air or water for domestic, commercial or industrial use, piping and/or pump(s) to move heated water and a tank for storage. The Company provides dealers and customers with a variety of services, including system design, energy efficiency, financial consulting and analysis, construction management and maintenance and monitoring. Solar electric and solar thermal systems are designed to take into account the customer�� location, site conditions and energy needs.

The Company competes with groSolar, Sunpower, Sunwize, BP Solar, Evergreen Solar and GE Solar.

Best Energy Companies To Own In Right Now: Joy Global Inc.(JOYG)

Joy Global Inc. engages in the manufacture and servicing of mining equipment for the extraction coal, copper, iron ore, oil sands, and other minerals worldwide. The company operates in two segments, Underground Mining Machinery and Surface Mining Equipment. The Underground Mining Machinery segment produces continuous miners, longwall shearers, powered roof supports, armored face conveyors, shuttle cars, flexible conveyor trains, roof bolters, battery haulers, continuous haulage systems, feeder breakers, conveyor systems, high angle conveyors, and crushing equipment, as well as longwall mining systems consisting of powered roof supports, an armored face conveyor, and a longwall shearer. This segment also rebuilds and services equipment, and sells replacement parts and consumables in support of installed base. The Surface Mining Equipment segment produces electric mining shovels, walking draglines, and rotary blasthole drills for open-pit mining operations. This segment also sells used electric mining shovels; and provides logistics and life cycle management support services, including equipment erections, relocations, inspections, service, repairs, rebuilds, upgrades, used equipment, new and used parts, enhancement kits, and training, as well as offers electric motor rebuilds and other products and services to the non-mining industrial segment. In addition, it offers wheel loaders, as well as jack-up rigs and ancillary equipment for the oil and gas drilling industries. Joy Global Inc. sells its products primarily to global and regional mining companies. The company was founded in 1884 and is headquartered in Milwaukee, Wisconsin.

Best Energy Companies To Own In Right Now: EcoloCap Solutions Inc (ECOS)

EcoloCap Solutions Inc. (EcoloCap), incorporated on March 18, 2004, is a development stage company. The Company is an integrated network of environmentally focused technology companies that design, develop, manufacture and sell cleaner alternative energy products.

The Company through its subsidiary Micro Bubble Technologies Inc. (MBT), developed and manufactures M-Fuel. The Company also developed the Carbon Nano Tube Battery (CNT-Battery), and the Nano Li- Battery both recyclable, rechargeable batteries. MBT has also developed a process that blends non-miscible liquids (oil and water) on a submicron level in order to create a non-emulsified fuel product that it calls EM-Fuel.

Best Energy Companies To Own In Right Now: Seadrill Limited(SDRL)

Seadrill Limited, an offshore drilling contractor, provides offshore drilling services to the oil and gas industries worldwide. It also offers platform drilling, well intervention, and engineering services. As of March 31, 2011 the company owned and operated 54 offshore drilling units, which consist of drillships, jack-up rigs, semisubmersible rigs, and tender rigs for operations in shallow and deepwater areas, as well as in benign and harsh environments. Seadrill Limited was founded in 1972 and is based in Hamilton, Bermuda.

Advisors' Opinion: - [By Travis Hoium]

Seadrill (NYSE: SDRL ) is already one of the biggest ultra-deepwater drilling rig owners in the world and now it's putting another $2.4 billion into the market to solidify its position as a leader in offshore drilling. The company announced the order of four more ultra-deepwater rigs at $600 million each for delivery in 2015. It now has nine drillships on order, which should significantly increase revenue over the next three years.�

- [By Dan Caplinger]

On Tuesday, Seadrill (NYSE: SDRL ) will release its latest quarterly results. The key to making smart investment decisions on stocks reporting earnings is to anticipate how they'll do before they announce results, leaving you fully prepared to respond quickly to whatever inevitable surprises arise. That way, you'll be less likely to make an uninformed knee-jerk reaction to news that turns out to be exactly the wrong move.

- [By Sean Williams]

Domestically, and adding to the point, the Gulf of Mexico is an opportunity for rapid growth in ultra-deepwater drilling. As my Foolish colleague Travis Hoium pointed out in January, Seadrill (NYSE: SDRL ) , a competitor to Halliburton, has about half its fleet contracted into 2017, demonstrating oil and gas companies' commitment to the region and belief that returns and finds will be sustainable. With the U.S. pushing for increased energy independence, Halliburton's name should be called often when it comes to Gulf of Mexico servicing and equipment contracts.

Best Energy Companies To Own In Right Now: SolarCity Corp (SCTY)

SolarCity Corporation (SolarCity), incorporated on June 21, 2006, is engaged in the design, installation and sale or lease of solar energy systems to residential and commercial customers, or sale of electricity generated by solar energy systems to customers. The Company sells renewable energy to its customers. As of December 12, 2012, the Company served customers in 14 states. The Company�� residential customers are individual homeowners and homeowners. The Company�� commercial customers represent several business sectors, including technology, retail, manufacturing, agriculture, nonprofit and houses of worship. The Company has installed solar energy systems for several government entities, including the the United States Air Force, Army, Marines and Navy, and the Department of Homeland Security. The Company purchases major components, such as solar panels and inverters directly from multiple manufacturers. As of September 30, 2012, its primary solar panel suppliers were Trina Solar Limited, Yingli Green Energy Holding Company Limited and Kyocera Solar, Inc., among others, and its primary inverter suppliers were Power-One, Inc., SMA Solar Technology, AG, Schneider Electric SA, Fronius International GmbH and SolarEdge Technologies, among others.

Solar Energy Products

The Company�� solar energy products include Solar Energy Systems, and SolarLease and power purchase agreement finance products. The major components of its solar energy systems include solar panels that convert sunlight into electrical current. Most of its solar energy customers choose to purchase energy from the Company pursuant to one of two payment structures: a SolarLease or a power purchase agreement. In both structures, the Company charges customers a monthly fee for the power produced by its solar energy systems. In the lease structure, this monthly payment is pre-determined and includes a production guarantee. In the power purchase agreement structure, the Company charges customers a fee per kilowatt! hour based on the amount of electricity actually produced by the solar energy system.

Energy Efficiency Products and Services

The Company�� energy efficiency products and services include home energy evaluation and energy efficiency upgrades. The Company sells home energy efficiency evaluations to new solar energy system customers and existing customers. The Company�� energy efficiency upgrade products and services address heating and cooling, air sealing, duct sealing, water heating, insulation, furnaces, weatherization, pool pumps and lighting. As of December 12, 2012, the Company had completed over 13,000 home energy evaluations and performed more than 2,000 energy efficiency upgrades.

Other Energy Products and Services

The Company�� other energy products and services include electric vehicle charging and energy storage. The Company installs electric vehicle (EV) charging equipment that it sources from third parties. SolarCity markets EV equipment to residential and commercial customers through retail partnerships with companies, such as The Home Depot, and through EV manufacturers and dealerships, such as its partnership with Tesla Motors, Inc. The Company is developing a battery management system built on its solar energy monitoring communications backbone. As of December 12, 2012, the Company had over 100 energy storage pilot projects under contract. As of December 12, 2012, the Company had sold over 750 charging stations.

Enabling Technologies

The Company�� enabling technologies include SolarBid Sales Management Platform, SolarWorks Customer Management Software, Energy Designer, Home Performance Pro and SolarGuard and PowerGuide Proactive Monitoring Solutions. SolarBid is a sales management platform, which incorporates a database of rate information by utility, sun exposure, roof orientation and a range of other factors to enable a detailed analysis and customized graphical presentation of each customer� �s savin! gs.

SolarWorks is the software platform the Company uses to track and manage project. Energy Designer is a software application its field engineering auditors use to collect pertinent site-specific design details on a tablet computer. Home Performance Pro is its energy efficiency evaluation platform that incorporates the United States Department of Energy�� Energy Plus simulation engine. Home Performance Pro collects and stores details of a building�� construction and energy use. SolarGuard and PowerGuide provide its customers a view of their home�� or business�� energy generation and consumption.

The Company competes with American Solar Electric, Inc., Astrum Solar, Inc., Petersen Dean, Inc., Real Goods Solar, Inc., REC Solar, Inc., Sungevity, Inc., Trinity Solar, Inc., Verengo, Inc., SunRun Inc. and Ameresco, Inc.

Advisors' Opinion: - [By Sean Williams]

SolarCity (NASDAQ: SCTY )

You know how I'm a staunch advocate for profitability?... Well, throw that out the window just this once!

- [By Aimee Duffy]

1. On-site green power generation

Wal-Mart ranks first�among U.S. companies for on-site green power generation. While�Intel (NASDAQ: INTC ) lays claim to impressive statistics like "100% green power use", it achieves that percentage primarily by buying renewable energy credits. Wal-Mart has 180 renewable energy projects around the world, including more than 150 solar installations and 26 fuel cell projects. The company's goal for 2013 is to bring solar power to 100 more store sites. Solar City (NASDAQ: SCTY ) does the bulk of the Wal-Mart's installations, if investors are interested in that angle.

Iran and global powers reach deal

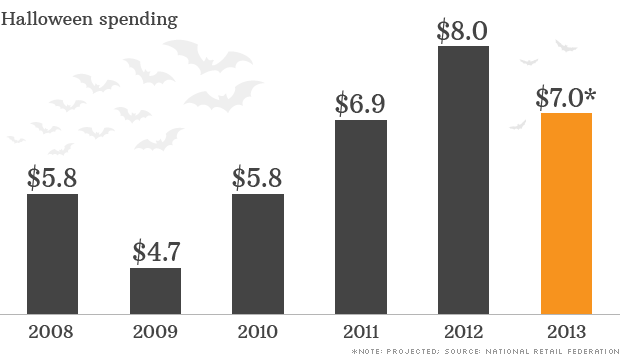

Iran and global powers reach deal  NEW YORK (CNNMoney) Consumers are spooked this Halloween -- and it's not just the ghosts, goblins, and ghouls.

NEW YORK (CNNMoney) Consumers are spooked this Halloween -- and it's not just the ghosts, goblins, and ghouls.  A Hyundai for the zombie apocalypse

A Hyundai for the zombie apocalypse

Getty Images

Getty Images  Enlarge Image

Enlarge Image  Eurozone Recovery Hits the Buffers

Eurozone Recovery Hits the Buffers  Name: John Grover Wilson

Name: John Grover Wilson Name: David S. Chang

Name: David S. Chang Name: John Thomas Deutsch

Name: John Thomas Deutsch Name: Kevin Hott

Name: Kevin Hott Name: David Latch

Name: David Latch Name: James Schwartz

Name: James Schwartz Name: Robert S. Peterson

Name: Robert S. Peterson Name: Bill Gross

Name: Bill Gross

How I make money mining bitcoins

How I make money mining bitcoins  Getty Images NEW YORK -- Home improvement maker Home Depot (HD) on Thursday apologized for a tweet that showed a picture of two African-American drummers with a person in a gorilla mask in between them and asked: "Which drummer is not like the others?" The tweet, from Home Depot's official Twitter account, @HomeDepot, was part of a "College Gameday" college football promotion on ESPN. It was quickly pulled, but not before people took screen shots of it and it was widely circulated on social media. NBC and CNBC, among others, reported on the Tweet.

Getty Images NEW YORK -- Home improvement maker Home Depot (HD) on Thursday apologized for a tweet that showed a picture of two African-American drummers with a person in a gorilla mask in between them and asked: "Which drummer is not like the others?" The tweet, from Home Depot's official Twitter account, @HomeDepot, was part of a "College Gameday" college football promotion on ESPN. It was quickly pulled, but not before people took screen shots of it and it was widely circulated on social media. NBC and CNBC, among others, reported on the Tweet.  Mark Lennihan/AP But not many individual investors were able to scoop up shares of the seven-year-old company at the IPO price. That's because the big boys -- institutional investors such as mutual funds and hedge funds -- grabbed those. So the question is -- in 140 characters or less -- should you buy in now that it's trading like any other issue? There's no easy answer, but we'll run through some of the pros and cons. First, Twitter (TWTR) is off to a fast start. The initial offering of 70 million shares was priced at $26 dollars, and the first trade was at $45.10 a share. That's a 73 percent jump. Trading, no doubt, will be very volatile for at least the next few days. Proponents like it because Twitter has become part of the vernacular, especially for people age 18-to-34 -- those most targeted by advertisers. They live in the Twitterverse, sending out messages of up to 140 characters. Some are as mundane as what you had for lunch today. Others are earthshaking such as when Twitter played a key role in the Arab Spring revolution. You can post your messages, and you follow other people who post. Entertainers Katy Perry, Justin Bieber and Lady Gaga all have more than 40 million followers. President Obama has nearly that many. The company has 232 million users worldwide, and its user base is still growing rapidly, up 39 percent from a year ago. The IPO price was raised several times in the weeks leading up the Thursday debut here, but still came in at what analysts consider a reasonable level, at least in comparison Facebook (FB) and other social networking companies. Now for some of the cons. The biggest negative is that Twitter has never made any money; never turned a profit. And it doesn't expect to earn a profit until 2015 at the earliest. Twitter is often compared to Facebook, but remember, Facebook was growing at a faster pace when it was the same size as Twitter is now. So it's public offering comes at an earlier stage of development. Analysts say the company's effort to monetize its huge fan base is still at an early stage. It hasn't proven that advertisers can successfully appeal to its audience, and that users won't be turned off be turned off by too many adds. And Twitter's pace of growth has slowed for seven consecutive quarters. There are still plenty of skeptics who say Twitter could be a flash in the pan. They say there's no guarantee it will even survive. The bottom line is, many advisers say there is no urgency to get into the stock right now. It's likely to be volatile of the coming days and weeks. So you might want to take a little bit of time to judge the company and its stock market value, before taking a leap of faith.

Mark Lennihan/AP But not many individual investors were able to scoop up shares of the seven-year-old company at the IPO price. That's because the big boys -- institutional investors such as mutual funds and hedge funds -- grabbed those. So the question is -- in 140 characters or less -- should you buy in now that it's trading like any other issue? There's no easy answer, but we'll run through some of the pros and cons. First, Twitter (TWTR) is off to a fast start. The initial offering of 70 million shares was priced at $26 dollars, and the first trade was at $45.10 a share. That's a 73 percent jump. Trading, no doubt, will be very volatile for at least the next few days. Proponents like it because Twitter has become part of the vernacular, especially for people age 18-to-34 -- those most targeted by advertisers. They live in the Twitterverse, sending out messages of up to 140 characters. Some are as mundane as what you had for lunch today. Others are earthshaking such as when Twitter played a key role in the Arab Spring revolution. You can post your messages, and you follow other people who post. Entertainers Katy Perry, Justin Bieber and Lady Gaga all have more than 40 million followers. President Obama has nearly that many. The company has 232 million users worldwide, and its user base is still growing rapidly, up 39 percent from a year ago. The IPO price was raised several times in the weeks leading up the Thursday debut here, but still came in at what analysts consider a reasonable level, at least in comparison Facebook (FB) and other social networking companies. Now for some of the cons. The biggest negative is that Twitter has never made any money; never turned a profit. And it doesn't expect to earn a profit until 2015 at the earliest. Twitter is often compared to Facebook, but remember, Facebook was growing at a faster pace when it was the same size as Twitter is now. So it's public offering comes at an earlier stage of development. Analysts say the company's effort to monetize its huge fan base is still at an early stage. It hasn't proven that advertisers can successfully appeal to its audience, and that users won't be turned off be turned off by too many adds. And Twitter's pace of growth has slowed for seven consecutive quarters. There are still plenty of skeptics who say Twitter could be a flash in the pan. They say there's no guarantee it will even survive. The bottom line is, many advisers say there is no urgency to get into the stock right now. It's likely to be volatile of the coming days and weeks. So you might want to take a little bit of time to judge the company and its stock market value, before taking a leap of faith.  Alamy Best Buy (BBY) is getting unduly cocky in its latest holiday ad. Comic actor Will Arnett reads a revised version of "'Twas the Night Before Christmas," featuring a father who knocks off his holiday shopping list with a single trip to the consumer electronics superstore. Arnett goes on to call Best Buy "the great showroom floor." The ad closes with "Your Ultimate Holiday Showroom" as graphic text. Best Buy is clearly trying to take back the word "showroom" at a time when "showrooming" has come to mean consumers kicking the tires of products at local retailers only to order them for less online. That's a real problem for bricks-and-mortar businesses, but nonetheless, Best Buy is making its actual showroom the centerpiece of this holiday season's marketing campaign. That's gutsy. It's also an ill-advised strategy. The Fatal Flaw in Best Buy's Turnaround Story Best Buy has certainly won back investors. The stock has nearly quadrupled since bottoming out last December. There's also probably nobody as confident of Best Buy CEO Hubert Joly. "A year ago people said that showrooming would kill Best Buy" he told The Wall Street Journal in an interview this week. "I think that Best Buy has killed showrooming." That's a brazen claim; Best Buy's fundamentals don't match its stock price. Same-store sales -- the key metric in the retail industry that measures how much the average established store is raking in relative to a year earlier -- have been consistently negative for the past three years. The store-level situation is also actually worse than even the reported numbers suggest. Best Buy is one of the growing number of retailers that include online sales in their same-store sales calculations. Dividing the growing number of BestBuy.com sales into the chain's store count artificially inflates the amount of merchandise that physical stores claim to be selling. No offense, Best Buy, but until you legitimately grow sales at the individual store level, showboating about your showroom is premature. You Can't Spell Holiday without H-O-L-D Between the buoyant stock price, its CEO's bravado, and the perpetually smug Arnett as a pitchman, one might expect Best Buy was headed for a blowout holiday shopping season. Well, analysts don't seem to think so. Analysts see Best Buy's sales sliding nearly 11 percent during the company's fiscal fourth quarter. Amazon.com (AMZN) on the other hand -- the company that supposedly Best Buy is winning the showrooming battle against -- is expected to soar 22 percent during retail's hottest quarter. Wall Street does see Best Buy's profitability continuing to improve, but that's a testament to Joly's skill at cutting costs and improving profit margins. He has certainly done a commendable job on that front, and that's ultimately the reason why the stock has been such a big winner in 2013. However, when it comes to the store's actual popularity, Best Buy is nowhere close to being the retailer that it used to be. The Long Way Down Best Buy has had more than a few bad breaks along the way. The economic slowdown didn't help. The widespread decision among consumers' to take a pass on high-priced 3-D TVs took a bite out of the chain's big-ticket sales. However, the digital revolution has stung Best Buy in more ways than merely the showrooming trend. It's true that more and more customers are armed with smartphones these days. Why buy a stereo receiver or a computer monitor at Best Buy when a few seconds on a smartphone can locate the same product being sold for a lot less online? Best Buy really can't compete on price with Amazon and other Web-based retailers that don't have to pay up for a retail presence. Worse, the smartphone and tablet revolutions hurt Best Buy by pulling the rug out from under its sales of vast quantities of physical media and software -- CDs, DVDs, and video games -- the products that Best Buy once used to lure customers in more often. You may only need a new dishwasher once a decade, but there are new music, movie, and game releases every week. Now that media has gone digital and downloadable, Best Buy has to find new ways to encourage shoppers to trek out to its stores. So far, it hasn't done that. If we go by the same-store sales figures and analyst holiday forecasts, Best Buy's brash advertising strategy amounts to little more than whistling past the graveyard -- and there's a plot waiting for it.

Alamy Best Buy (BBY) is getting unduly cocky in its latest holiday ad. Comic actor Will Arnett reads a revised version of "'Twas the Night Before Christmas," featuring a father who knocks off his holiday shopping list with a single trip to the consumer electronics superstore. Arnett goes on to call Best Buy "the great showroom floor." The ad closes with "Your Ultimate Holiday Showroom" as graphic text. Best Buy is clearly trying to take back the word "showroom" at a time when "showrooming" has come to mean consumers kicking the tires of products at local retailers only to order them for less online. That's a real problem for bricks-and-mortar businesses, but nonetheless, Best Buy is making its actual showroom the centerpiece of this holiday season's marketing campaign. That's gutsy. It's also an ill-advised strategy. The Fatal Flaw in Best Buy's Turnaround Story Best Buy has certainly won back investors. The stock has nearly quadrupled since bottoming out last December. There's also probably nobody as confident of Best Buy CEO Hubert Joly. "A year ago people said that showrooming would kill Best Buy" he told The Wall Street Journal in an interview this week. "I think that Best Buy has killed showrooming." That's a brazen claim; Best Buy's fundamentals don't match its stock price. Same-store sales -- the key metric in the retail industry that measures how much the average established store is raking in relative to a year earlier -- have been consistently negative for the past three years. The store-level situation is also actually worse than even the reported numbers suggest. Best Buy is one of the growing number of retailers that include online sales in their same-store sales calculations. Dividing the growing number of BestBuy.com sales into the chain's store count artificially inflates the amount of merchandise that physical stores claim to be selling. No offense, Best Buy, but until you legitimately grow sales at the individual store level, showboating about your showroom is premature. You Can't Spell Holiday without H-O-L-D Between the buoyant stock price, its CEO's bravado, and the perpetually smug Arnett as a pitchman, one might expect Best Buy was headed for a blowout holiday shopping season. Well, analysts don't seem to think so. Analysts see Best Buy's sales sliding nearly 11 percent during the company's fiscal fourth quarter. Amazon.com (AMZN) on the other hand -- the company that supposedly Best Buy is winning the showrooming battle against -- is expected to soar 22 percent during retail's hottest quarter. Wall Street does see Best Buy's profitability continuing to improve, but that's a testament to Joly's skill at cutting costs and improving profit margins. He has certainly done a commendable job on that front, and that's ultimately the reason why the stock has been such a big winner in 2013. However, when it comes to the store's actual popularity, Best Buy is nowhere close to being the retailer that it used to be. The Long Way Down Best Buy has had more than a few bad breaks along the way. The economic slowdown didn't help. The widespread decision among consumers' to take a pass on high-priced 3-D TVs took a bite out of the chain's big-ticket sales. However, the digital revolution has stung Best Buy in more ways than merely the showrooming trend. It's true that more and more customers are armed with smartphones these days. Why buy a stereo receiver or a computer monitor at Best Buy when a few seconds on a smartphone can locate the same product being sold for a lot less online? Best Buy really can't compete on price with Amazon and other Web-based retailers that don't have to pay up for a retail presence. Worse, the smartphone and tablet revolutions hurt Best Buy by pulling the rug out from under its sales of vast quantities of physical media and software -- CDs, DVDs, and video games -- the products that Best Buy once used to lure customers in more often. You may only need a new dishwasher once a decade, but there are new music, movie, and game releases every week. Now that media has gone digital and downloadable, Best Buy has to find new ways to encourage shoppers to trek out to its stores. So far, it hasn't done that. If we go by the same-store sales figures and analyst holiday forecasts, Best Buy's brash advertising strategy amounts to little more than whistling past the graveyard -- and there's a plot waiting for it.